One of my least favorite things to hear from a potential client is, “I’m paying almost nothing in taxes this year!”

More often than not, this is someone who recently retired, maybe a little bit early, and their taxable income all but disappeared. They have a unique set of circumstances:

- No regular paycheck

- No RMDs

- No pension

- No Social Security, etc.

- Little to no taxable income…

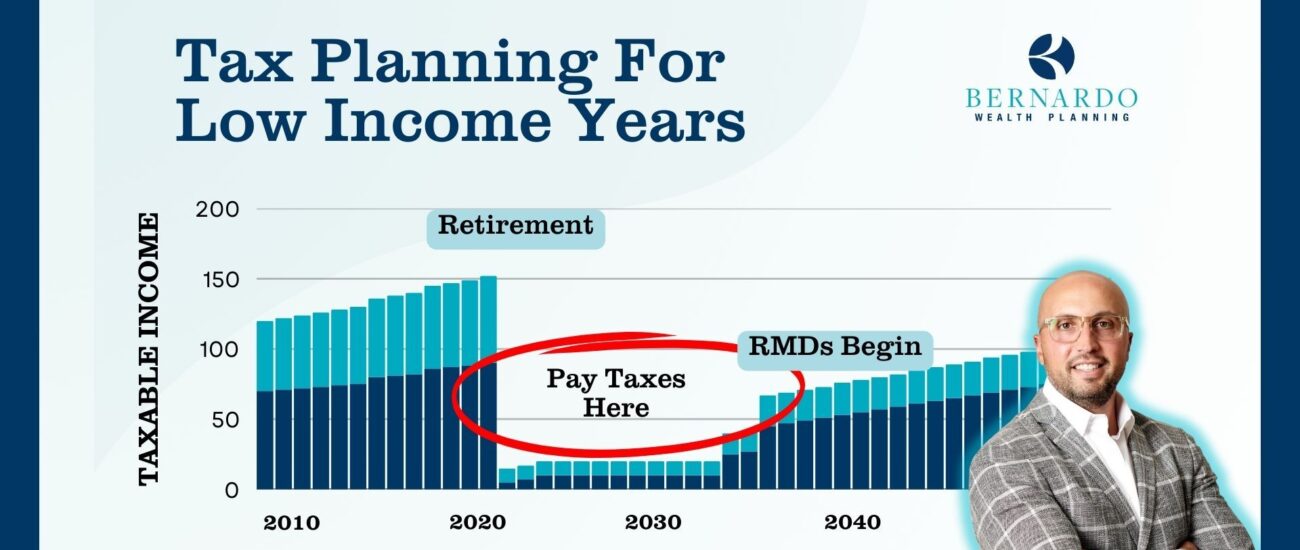

The problem is that while it can feel like winning to pay the lowest taxes possible this year, it’s like sprinting the first mile of a marathon. We want to win the whole race, not just this part of it. Let me explain why the real tax opportunity lies in those low-income years right after you retire.

The Low-Income Sweet Spot

When you retire, your earned income drops off, which is great at first—it feels like a break. But once you hit age 73, you’ll have to start taking Required Minimum Distributions (RMDs) from your retirement accounts. Those distributions are taxed as income, which can push you into a higher tax bracket if you haven’t planned ahead.

Adding to my bullet points above: pensions, Social Security, other investments that begin paying out. Suddenly, your taxable income can push you back up into a bracket as high as your working years (if not higher).

That’s why we want every client to see the incredible tax planning opportunity that these low taxable income years represent. We’re not trying to win by paying no taxes. We’re trying to push as much money through these low tax brackets as possible.

Roth Conversions: Why It Makes Sense

One of the most effective moves during these low-income years is a Roth conversion. Essentially, you convert some of your traditional IRA or 401(k) into a Roth IRA. You’ll pay taxes on the amount you convert, but because your taxable income is low in retirement, you’ll likely pay a lower tax rate than you would when RMDs start.

The real benefit of a Roth IRA is that once your money is in there, it grows tax-free, and any future withdrawals are also tax-free. So, by converting now while your income is low, you lock in a lower tax rate for future withdrawals. It’s a strategy that can save you a lot in taxes over the long term.

Draw from Your IRA Early

Another option is to start drawing from your IRA before RMDs are required. Yes, it means paying taxes on the withdrawals now, but the benefit is that you’re reducing your IRA balance early, lowering the future impact of those RMDs. The result? Less taxable income in the future, and more control over your tax situation.

Don’t Let the Opportunity Pass You By

I can’t tell you how many times I’ve seen investors miss this opportunity because they were playing the wrong tax game. They have large IRAs and don’t take advantage of those first few years with little to no income. They assume that avoiding taxes during those years is a win, but in reality, they’re letting a prime tax strategy slip by. They tend to realize the mistake as soon as RMDs and other income push their tax bill right back up.

So, here’s the key takeaway: don’t waste those first few years of low income. This is your chance to make moves like Roth conversions or early IRA withdrawals that could significantly lower your taxes in the future. By planning now, you can smooth out your tax burden and avoid big surprises later on.

If you’re nearing retirement or already retired, it’s a good idea to chat with one of our financial advisors who can help you make the most of this unique period. With the right strategy, you can not only save money on taxes but also gain more control over your financial future.

In the end, those low-income years aren’t just a break from working—they’re your tax advantage. Don’t miss out.